BestCashCow recently introduced two first of their kind online tools to help borrowers find banks that can provide the loans they need.

BestCashCow’s Bank Loan FirstStep provides borrowers with the ability to quickly find the top lenders in their local community, state and across the country for major loan categories, including: construction and development, commercial real estate, residential, auto, small business, farm, credit card, and commercial and industrial loans.

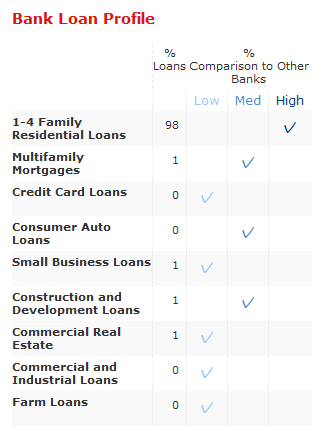

Bank Loan QuickCheck creates a lending profile for every FDIC insured institution that gives consumers an idea of where the bank focuses its lending efforts. The tool also compares lending profiles of banks within each state so that consumers can quickly see which banks stand out in terms of focusing on a certain type of loan category. Users can then contact the individual banks for specific information on loan rates.

"This is an excellent starting point for anyone looking to borrow money," said Sol Nasisi, president of BestCashCow. "For the first time, consumers can access loan profiles for all 7,181 FDIC banks and can compare banks to state averages to find which banks specialize in the types of loans they need. “This will save borrowers time and match them up with the right lenders. It’s a win-win for banks and borrowers."

Bank Loan FirstStep and QuickCheck were created using FDIC data. The company has begun work on extending QuickCheck and FirstStep to credit unions.

Add your Comment

or use your BestCashCow account