What’s a ‘Reverse Mortgage’?

A reverse mortgage is a type of mortgage that allows a homeowner to borrow money against the value of their home. The borrower does not have to repay the mortgage’s principal or interest. The mortgage is repaid when the house is sold or the borrower dies.

After accounting for the mortgage amount, the rate of home appreciation, the loan’s length, and the accrued interest rate, the transaction is structured so that it ensures the amount of the loan will not exceed the home’s value over the loan’s life.

Looking for a regular mortgage? Get the best rates here.

The lender often requires that there are no liens against your home. All existing liens should be paid off with proceeds from the reverse mortgage.

A reverse mortgage provides people with the income they can tap into. The main advantage of a mortgage is that the borrower’s credit rating is not relevant, and in some cases, may not even be checked since the borrower does not need to make any payments.

With a reverse mortgage, the home serves as collateral. When the borrower dies, the home must be sold to repay the mortgage. In some cases, the borrower’s heirs will have the option of repaying the mortgage and retaining ownership of the home.

The origination costs on a reverse mortgage are much higher than other types of mortgages. These costs accrue interest and become part of the initial mortgage balance. If the borrower is a senior citizen with good credit they should carefully analyze their options to determine if a home equity loan or traditional mortgage is a better choice for their situation.

How Does a Reverse Mortgage Work?

A reverse mortgage is designed to help seniors become financially stable during retirement. This is a type of home equity loan, intended for people who have a fixed income. The money available to a borrower is determined by the borrower’s age, how much the borrower owes on their mortgage and other home loans, and the home’s values.

Older borrowers can draw more money through this loan program. The youngest spouse living in the home is the basis for calculating the loan amount.

A borrower can receive payments from this mortgage as a line of credit, a monthly payment, or a lump sum.

Borrowers won’t have to make payments as long as they – or their spouse – lives in the home. Yet, if both the borrower and their spouse pass away, or move out of the home, then payment is due.

If the borrower, or their heirs, sell the home, the proceeds go towards repaying the loan. If the home is worth less than the amount owed on the loan, all the sales proceeds will go towards repaying the loan and the mortgage will be considered paid.

There have been numerous news reports in the past few years of spouses being evicted after one of them, the one listed on the reverse mortgage, passes away. The new reverse mortgage rules, which took effect in 2014, offer better protection for the nonborrowing spouse, which allows them to stay in their home, after the borrower’s death.

Will I Still Own My Home?

Some people believe that if you have a reverse mortgage, the bank owns your home. That’s not true.

With a reverse mortgage, the bank has a lien on the house, the same as a tradition mortgage or any type of home loan. The mortgage has the first claim on any proceeds from a home sale. But, the home itself is still owned by the borrower.

There are some restrictions that apply to ownership of a home with a reverse mortgage.

This is a type of owner-occupied loan. The home must be occupied as a primary residence by the borrower or their spouse. The house cannot be leased to another resident.

Why Do People Take Out a Reverse Mortgage?

Many borrowers use their reverse mortgage to pay down their debts and cut their monthly paymnts. These debts include consumer debt, home equity loans, and the existing mortgage.s

Others may use this loan in the form of an open line of credit to help cover unexpected expenses.

By having funds in a line of credit, a senior can hold onto other assets like stocks and bonds. They can use the funds from a reverse mortgage to cover unexpected costs, instead of having to sell off their other assets.

The Popularity of Reverse Mortgages

In the 1990 fiscal year, the program’s first year, only 157 reverse mortgages were made, according to the NRMLA. The number of reverse mortgages taken out annual, spiked in the 2000s, peaking at 114,692 loans in the 2009 fiscal year.

During the Great Recession, the number dropped sharply, going down to 79,106 the next year. During the 2015 fiscal year, which dated from Oct. 1, 2014, through Sept. 30, 2015, people took out 53,372 new reverse mortgage loans. This was slightly higher than the 51,642 reverse mortgages taken out in 2014.

Since this program began, a total of 911,314 reverse mortgages has been taken out, according to the NRMLA. That number is expected to reach 1 million during the first half of 2016.

Take the Interest and Fees into Account

If you take out a tradition mortgage, the interest is included in your monthly payments. You pay a little bit of interest at a time. Since a borrower doesn’t make payments, during the life of the loan, the interest on a reverse mortgage builds up. The interest rate for a reverse mortgage is like other types of mortgages.

That means over the life of the loan, the amount of debt will increase. The interest can “eat up” any equity remaining in your home.

You also need to remember that although a reverse mortgage borrower doesn’t have a mortgage payment to make each month, the homeowner will still be responsible for paying taxes, homeowners association fees, homeowners insurance and other costs associated with homeownership. If a homeowner fails to make these payments, it may result in a default, which means the immediate repayment of the reverse mortgage.

Do Your Research

There are many resources available online to help people understand reverse mortgages.

The National Council on Aging and AARP have online resources to help explain reverse mortgages to potential borrowers.

The Federal Housing Authority, the Consumer Financial Protection Bureau, and other government agencies also offer information and online guides with information about reverse mortgages.

Talk to a Professional

Before getting a reverse mortgage, a potential borrower must attend a counseling session with a certified reverse mortgage counselor. This must be done before completing the application.

Lenders must provide a potential borrower with a list of several reverse mortgage counselors or agencies. It’s up to the client to choose a counselor and schedule a session. If the lender says you don’t have to attend a meeting or tries to steer you towards a specific counselor, that should be a red flag.

If you look on the HUD website, you’ll find a complete roster of certified HECM counselors.

Bring Your Family into the Conversation

Most lenders will say that the decision of whether or not, to take out a reverse mortgage should be made between the borrower and their reverse mortgage sales person. But, since this decision will affect the entire family, you may consider this to be a family decision.

A potential borrower should consider discussing their decision and how it may affect their heir’s inheritances and their estate. This should be done early in the reverse mortgage process.

Watch Out For – and Report – Scams

Reverse mortgage counselors and lenders try to watch out for clients who may be told to get a reverse mortgage as part of a scam. However, they are not able to catch all the fraudsters.

One scam involves people who offer seniors in a low-income community a “free” house. They move them into recently renovated fixer-uppers. Then they have them take out a reverse mortgage, and the scammer takes all the loan proceeds.

Other borrowers have been scammed when their house went into foreclosure. They were approached by an unscrupulous lawyer who promises to fix their problem for a fee. The lawyer disappears after the fee is paid.

If you suspect a scam, or if someone involved in your transaction is not following the law, tell your lender, loan office and reverse mortgage counselor. Also, file a complaint with your state Attorney General’s office, Federal Trade Commission, or the state’s banking regulatory agency.

Explore Other Options

Reverse mortgages are not perfect for everyone, so you should look for other options before you take this step.

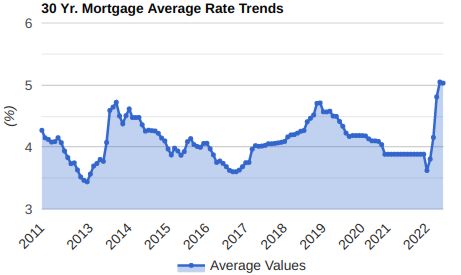

First, look at refinancing the mortgage while interest rates are low in order to trim your payments.

If you have trouble making mortgage payments, you should research government programs in your area.

There are many different government programs that reduce your loan balance and make it affordable to stay in your home. These programs have various names depending on the state, like Florida’s Hardest-Hit Fund and Keep Your Home California. There are mortgage assistance programs available from some local governments.

And there’s a regular home equity loan which can help you get immediate cash, as long as you can handle another monthly payment.