With so many people walking away from their mortgages in recent years, it raises the question: Is walking away from your mortgage the moral thing to do? In many cases, the bank is willing to forgive the remainder of the loan for people who simply cannot afford to make their payments any longer and decide to leave their home behind. But what about those who don’t have that option and the bank isn’t being as understanding and forgiving?

Many people who refuse to walk away from their mortgage despite owing double or even triple what their home is currently worth have made that decision because of their morals. Many of these homeowners look to the Bible as the guideline for their decisions and there are verses that would prohibit, or at least discourage the act of walking away from a financial obligation such as a mortgage regardless of the circumstances.

In Proverbs 37:21 (Old Testament), the Bible says this: “An evil person borrows and never pays back.” These are harsh words especially for mortgage borrowers who are considering or have already done a “strategic default.” A strategic default is when a homeowner decides to simply stop paying their mortgage even though they have the financial means to do so. They simply stop paying because the home is worth less than what they owe on it. Many people would say this is immoral because the homeowner made an agreement to pay and they simply stopped paying.

In addition to walking away from their financial obligations, there are other ramifications. For instance, walking away from your mortgage eventually leads to the house going through foreclosure. With each foreclosed home in a neighborhood, the property values of the surrounding homes also come down. This means that walking away not only impacts the bank that owns the home, but it affects your neighbors and their finances, too.

On the other hand, what about people who simply cannot afford to pay their mortgage any longer and they decide to walk away? The answer to this question is a little tougher. Many of these homeowners entered into contracts several years ago but have since suffered hardship due to medical reasons, job loss or an increase in mortgage payments due to their rates adjusting. If these people simply do not have the means to make their mortgage payments, are they being immoral as well by walking away?

For many homeowners who decide to walk away from their mortgage, it is not a moral issue but rather a financial issue. Since businesses are allowed to declare bankruptcy and back out on their financial obligations, some individuals feel that they should be able to rightfully do the same thing. While it may make good financial sense for a homeowner, is it the moral thing to do?

There are many options to consider before simply walking away from your mortgage. From refinancing to loan modifications and forbearances, it is important to try all of your options before you simply mail your keys back to your lender. If every other option has been considered and tried, do you still think it is immoral to walk away?

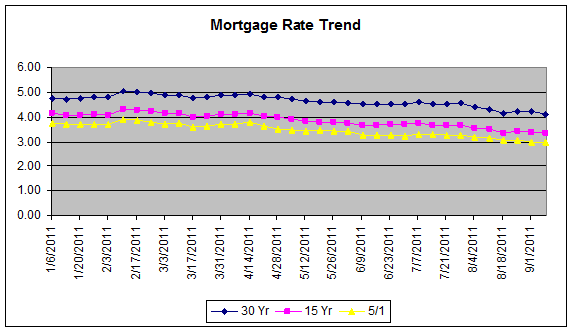

Considering refinancing as an alternative to foreclosure? See mortgage rates.