Savings Account National Average Rate: 0.23% ?

Advertiser Disclosure

| ONLINE BANKS | APY? | MIN? |

Climate Grade? |

||

|---|---|---|---|---|---|

|

|

3.75% | $1,000 |

Learn More on the First Foundation Bank website |

||

| Earn 10x the national savings average. | |||||

|

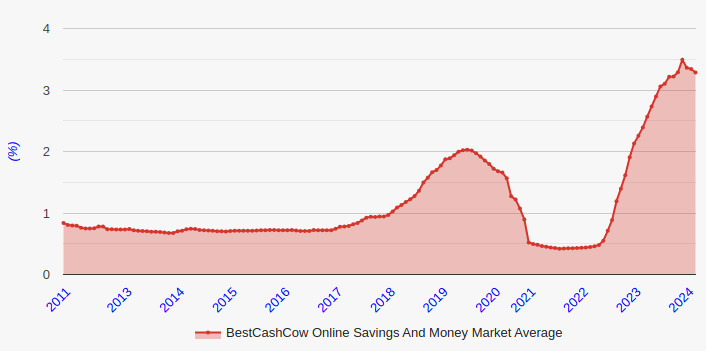

The Federal Reserve under Fed Chairman Jerome Powell has lowered interest rates by 25 basis points for the third time since September. The Fed funds rate following the December meeting now stands at a target of 3.50% to 3.75%. There were three dissents to today's quarter point cut. Chicago Fed President Austan Goolsbee and Kansas City Fed President (...read more in the Recent Articles section below). |

|||||

|

|

4.45% |

$100 |

Learn More | ||

|

Rate requires download of bank app and recording of over 12,500 average daily steps (or 10,000 if over age of 65). Customers maintaining $5,000 in a checking account may qualify for 4.75% rate.

|

|||||

|

JGothelf | Oct 11, 2022 Glad to have found this one and thanks to bestcashcow for not hiding the best rates like bankrate does Read More |

|||||

|

|

4.30% |

$25,000 |

C | Learn More | |

|

Online Savings Account. Account is indicated as not currently available to new customers, but bank accepts new customers who sign up to be notified after 1-2 weeks.

|

|||||

|

redstate jeff | Oct 29, 2024 Agree with the prior review even though it is 10 years old. It is shady and it doesn't show up on other sites. However, they did pay me 5.30% and although it is recently lowered to 5.15% it is still the b... |

|||||

|

|

4.25% |

$100 |

Learn More | ||

|

Quontic Money Market Account.

|

|||||

|

JuanVelasco | Mar 17, 2023 STAY AWAY ! They closed my accounts with no warning. After multiple successful direct deposits and mobile checks deposits, they claimed one of the three checks I deposited a few days ago was fake. No... |

|||||

|

|

4.20% |

$100 |

B | Learn More | |

|

Last change:

↓0.15% on October 6.

|

|||||

|

Gary Smith | Jan 28, 2025 4.75% is an introductory rate and they are not openly clear about that. Don't expect 4.75% to continue. They are otherwise competitive. Read More |

|||||

|

|

4.20% |

$500 |

Learn More

|

||

|

|

4.16% |

$0 |

D | Learn More | |

|

Last change:

↓0.05% on November 24.

|

|||||

|

2 Months with Vio Bank | Sep 4, 2025 And I discovered that they play bait and switch and have no problems lying. This system won't let me give it zero or negative stars so I have given it one, but that is at least one too many. Read More |

|||||

|

|

4.10% |

$2,500 |

B | Learn More | |

|

Online Savings Account.

|

|||||

|

lrcbob | Jul 26, 2024 Multiple roadblocks trying to set up a savings account with Ivy Bank and my application was ultimately declined, in spite of my multiple CDs among three banks, stock investments, eleven credit cards, and c... Read More |

|||||

|

|

4.05% |

$0 |

D | Learn More | |

|

Last change:

↓0.15% on November 18.

|

|||||

|

lrcbob | Jul 26, 2024 Multiple roadblocks trying to set up a savings account with Jenius Bank and my application was ultimately declined, in spite of my multiple CDs among three banks, stock investments, eleven credit cards, an... Read More |

|||||

|

|

4.05% |

$100 |

C | Learn More | |

|

High-Yield Savings Account. Outbound transfers limited to $10,000/day or less.

|

|||||

|

m abram | Jul 4, 2025 Bread's current 6-month CD is 4.45%, not 4.35%. Read More |

|||||

|

|

4.05% 4.00% |

$50,000 $1 |

Learn More | ||

|

Last change:

↓0.10% on October 13.

|

|||||

|

jp2 | Jul 1, 2022 not really an onllne bank. compare this interface that gives you no information with that of any other bank (I cannot even confirm the rate). cannot switch in and out of cds or np cds. just not an online b... Read More |

|||||

|

|

4.02% |

$1 |

C | Learn More | |

|

Bank was bailed out by Steven Mnuchin in March 2024 but may still fail. External transfers take at least 3 business days and are limited to $50,000/day and $200,000/month.

|

|||||

|

smithy1968 | Apr 20, 2024 Even staying well within FDIC limits, the frustration isn't worth your time! Dopey bank trying desperately to avoid govt closure. Read More |

|||||

|

|

4.01% |

$2,500 |

C | Learn More | |

|

Direct Money Market Account.

|

|||||

|

79Thru | Mar 21, 2023 Parent seems to be owned by a large Chilean bank. Not saying this is good or bad, but it is complication, especially in the current environment. Read More |

|||||

|

|

4.00% |

$0 |

A | Learn More | |

|

Growth Savings |

|||||

|

lrcbob | Jul 26, 2024 Multiple roadblocks trying to set up a savings account with Forbright and my application was ultimately declined, in spite of my multiple CDs among three banks, stock investments, eleven credit cards, and ... |

|||||

|

|

4.00% |

$100 |

Learn More | ||

|

bws/esc | Apr 27, 2023 have had 3 cd accounts. all interactions with instructions for disposition of funds were never exactly enacted as discussed and requests for confirmatory emails never sent with details as terms discussed. ... Read More |

|||||

|

|

4.00% |

$2,000 |

Pending | Learn More | |

|

Surge Money Market. Bank reports that this rate is available for new accounts only. External transfers are limited to $5,000/day and are not free.

|

|||||

|

Jason T | May 30, 2023 They really do pay this amount, but the account lacks any functionality and they are constantly looking for some sort of add-on fee to enable them to claw back the interest. Any bank with a higher rate an... Read More |

|||||

|

|

4.00% |

$5,000 |

Learn More | ||

|

Online transfers limited to $1,500 per day and $10,000 per month. |

|||||

|

AEM | Sep 18, 2023 I agree with another user, this bank is very poorly put together, and may very well be an operation in large part used to extract and sell people's personal information. I called customer service and had ... Read More |

|||||

|

|

4.00% 3.60% |

$250,000 $0 |

D | Learn More | |

|

Last change:

↓0.10% on December 7.

|

|||||

|

LenaL | May 2, 2022 Barclays is the worst. Transfer speeds even worse than Synchrony now. Service is worse than anything. Save yourself the trouble of getting sucked into rates that are sometimes competitive and choose anythi... |

|||||

|

|

3.96% |

$50,000 |

B | Learn More | |

|

New money only. Requires Direct Deposit. Account carries a $15 monthly service charge.

|

|||||

|

tjgarnett | Mar 2, 2024 Attracted to the name, but the service had too many steps so I didn't open an account. |

|||||

|

|

3.90% |

$0 |

C | Learn More | |

|

Performance Savings

|

|||||

|

smithy1968 | Mar 20, 2025 A non-customer-friendly organization that just switches between two contaminated brands trying to bring back some sort of goodwill that it had before it started selling fake foreign currency CDs in 2006 an... Read More |

|||||

|

|

3.90% |

$0 |

Learn More | ||

|

Personal Savings Account.

|

|||||

|

JBaker65 | May 6, 2023 Fully functional bank account that would be great for my needs, but the quarterly interest payment thing is a real nuisance. I wish they would change it. It isn't market. |

|||||

|

|

3.90% |

$0 |

Learn More | ||

|

Last change:

↓0.20% on February 6.

|

|||||

|

HAL1975 | Aug 2, 2023 Sallie mae is just a horrible institution. We've done business with them before and swore on the holy bible not to go near there again, but a 18 mos cd at 5.55% brought us back. |

|||||

|

|

3.90% |

$100 |

Pending | Learn More | |

|

Direct Savings. Bank reports that this rate is available for new accounts only.

|

|||||

|

Neil | Dec 18, 2023 I submitted a CD application 18 months 5.50 APY over a week ago and my application was declined no reason was given, I have the funds in another bank for transfer, credit score over 800. I think the reason... Read More |

|||||

|

|

3.85% |

$0 |

Learn More | ||

|

Last change:

↓0.05% on May 29.

|

|||||

|

HAL1975 | Aug 2, 2023 Sallie mae is just a horrible institution. We've done business with them before and swore on the holy bible not to go near there again, but a 18 mos cd at 5.55% brought us back. |

|||||

|

|

3.85% |

$1 |

Learn More | ||

|

Online Savings Account.

|

|||||

|

American Banker | Apr 7, 2023 Good luck deploying those high yield savings into profitable investments. It’s always a bad strategy … unbridled growth using volatile deposits forcing them to go out on the risk spectrum to make a dec... |

|||||

|

|

3.85% |

$10,000 |

Learn More | ||

|

Last change:

↓0.20% on November 13.

|

|||||

|

an | Apr 25, 2022 We would not be having all this trouble with people sealing money out of other people's bank accounts if we were to just stop using fancy banking like onlinebanki |

|||||

|

|

3.85% |

$25,000 |

Learn More | ||

|

Jumbo Savings.

|

|||||

|

BW | Jul 17, 2021 I've been with this bank for 6 months and have not had any problems. Bill pay works good. The 24 month investing CD is another vechile I use. Rates are above average considering the national rate. I'd reco... Read More |

|||||

|

|

3.82% 3.55% |

$0 $1 |

Learn More | ||

|

LevelUp Savings Account. Requires direct deposit of at least $250/month. Bank's standard online savings rate is 3.50% APY.

|

|||||

|

jaydub | Aug 18, 2025 Sophomoric as hell. I opened a LevelUp account for the 4.40% rate (now 4.20%). Rate requires automatic $250 deposit each month which I made, but I now realized that I never got that rate. Customer servic... |

|||||

|

|

3.81% |

$50 |

B | Learn More | |

|

Last change: ↑1.81% on February 4. |

|||||

|

tjgarnett | Mar 2, 2024 Attracted to the name, but the service had too many steps so I didn't open an account. |

|||||

|

|

3.80% |

$1 |

C | Learn More | |

|

High Yield Savings Account.

|

|||||

|

Yat 1965 | Mar 19, 2022 Problem with ties to puppy mills. I closed a cct. https://www.americanbanker.com/news/tab-bank-dragged-into-seedy-world-of-puppy-mill-loans-by-fintech-partner |

|||||

|

|

3.80% 2.02% |

$100,000 $0 |

C | Learn More | |

|

Performance Money Market

|

|||||

|

smithy1968 | Mar 20, 2025 A non-customer-friendly organization that just switches between two contaminated brands trying to bring back some sort of goodwill that it had before it started selling fake foreign currency CDs in 2006 an... Read More |

|||||

|

|

3.77% |

$100 |

D | Learn More | |

|

Cornerstone Money Market Account. Bank reports that this account is available to new customers only. Old account holders in the savings product are earning 1.10%.

|

|||||

|

2 Months with Vio Bank | Sep 4, 2025 And I discovered that they play bait and switch and have no problems lying. This system won't let me give it zero or negative stars so I have given it one, but that is at least one too many. Read More |

|||||

|

|

3.75% | $1,000 |

Learn More on the First Foundation Bank website |

||

| Earn 10x the national savings average. | |||||

|

The Federal Reserve under Fed Chairman Jerome Powell has lowered interest rates by 25 basis points for the third time since September. The Fed funds rate following the December meeting now stands at a target of 3.50% to 3.75%. There were three dissents to today's quarter point cut. Chicago Fed President Austan Goolsbee and Kansas City Fed President (...read more in the Recent Articles section below). |

|||||

|

|

3.75% |

$0 |

D | Learn More | |

|

Last change:

↓0.15% on December 22.

|

|||||

|

smithy1968 | Apr 20, 2024 Save your tears for another day. Very frustrating. 1-star. Read More |

|||||

|

|

3.75% |

$0 |

Learn More | ||

|

Online Savings

|

|||||

|

JuanVelasco | Mar 17, 2023 STAY AWAY ! They closed my accounts with no warning. After multiple successful direct deposits and mobile checks deposits, they claimed one of the three checks I deposited a few days ago was fake. No... |

|||||

|

|

3.75% |

$1,000 |

Learn More | ||

|

External outbound transfers are limited to $25,000 per day.

|

|||||

|

Az1 | Aug 26, 2022 Too slow to raise rates. Read More |

|||||

|

|

3.75% |

$5,000 |

C | Learn More | |

|

Platinum Savings. Bank reports that this rate is available for new accounts only.

|

|||||

|

MrBond | Feb 25, 2023 I have been working for this company more than 5 years. I would not recommend any investment with First Citizens Bank. They are the worst performer on the market based on the customer and employee reviews... Read More |

|||||

|

|

3.75% |

$5,000 |

C | Learn More | |

|

Last change:

↓0.25% on December 15.

|

|||||

|

Michael Roberts | Sep 16, 2025 This bank is a robber! Read More |

|||||

|

|

3.75% |

$25,000 |

Learn More | ||

|

Not accepting new accounts online at this time.

|

|||||

|

opal@8 | Dec 13, 2019 yes good |

|||||

|

|

3.70% |

$10,000 |

Learn More | ||

|

Last change:

↓0.10% on December 15.

|

|||||

|

A Terkowitz | Feb 15, 2024 I have always had great experiences with short-term CDs from this bank. No delays. |

|||||

|

|

3.67% |

$500 |

Learn More

|

||

|

Last change: ↓0.15% on November 13. |

|||||

|

|

3.66% |

$1,000 |

C | Learn More | |

|

CIBC Agility Savings Account.

|

|||||

|

ytr0171 | Jul 23, 2023 easy to work with but the rate isn't competitive. not even the leading savings rate banks are competitive versus short us treasuries. Read More |

|||||

|

|

3.65% |

$0 |

B | Learn More | |

|

External transfers may take up to 3 business days and may be limited to $25,000/day.

|

|||||

|

mcriss | Oct 23, 2023 Synchrony Bank recently closed 3 of my accounts with them and this decision was completely unwarranted. I had two Guitar Center cards and one Levin Furniture card. I found out about this through a push not... Read More |

|||||

|

|

3.65% |

$1 |

B | Learn More | |

|

A Terkowitz | Feb 15, 2024 best bank on the list but no longer the most competitive Read More |

|||||

|

|

3.65% |

$5,000 |

Learn More | ||

|

Last change:

↓0.20% on November 12.

|

|||||

|

Richard | Jul 1, 2022 Very easy opening process and wonderful staff. |

|||||

|

|

3.61% |

$0 |

Learn More | ||

|

Bank reports that this rate is for new customers only. Bank also charges ACH transfer fees and routinely lowers rates for existing customers below those advertised.

|

|||||

|

LarryMass | Dec 8, 2020 Everyone here in Boston raves about Salem Five but it is shithole operation filled with nasty entitled people. As for this online savings product, the fees are ridiculous, the transfer charges are obnoxiou... Read More |

|||||

|

|

3.61% |

$30,000 |

Learn More

|

||

|

|

3.60% |

$0 |

Learn More | ||

|

Bait and Swich | May 17, 2022 Not what it seems. Avoid! Read More |

|||||

|

|

3.60% |

$100 |

Learn More | ||

|

Last change:

↓0.20% on December 15.

|

|||||

|

Yolanda Gilruth | Jun 12, 2022 I have a small question Read More |

|||||

|

|

3.56% 2.79% |

$100,000 $50,000 |

Learn More

|

||

|

|

3.55% 3.45%3.25% |

$1,000,000 $100,000$0 |

B | Learn More | |

|

Last change:

↓0.10% on December 22.

|

|||||

|

NRB | Mar 14, 2018 Poor service. Condescending attitude. Savings application denied without giving reason (Equifax file had a freeze because of hacking history) and not advising customer of need to unfreeze credit file for a... Read More |

|||||

|

|

3.50% |

$0 |

Learn More | ||

|

an | Apr 25, 2022 We would not be having all this trouble with people sealing money out of other people's bank accounts if we were to just stop using fancy banking like onlinebanki |

|||||

|

|

3.50% |

$0 |

C | Learn More | |

|

High-Yield Savings Account.

|

|||||

|

Yeller | May 8, 2023 STAY BELOW FDIC limits. This is a desperate product unleashed from a distressed bank! Read More |

|||||

|

|

3.50% |

$0 |

Learn More | ||

|

Last change:

↓0.25% on December 16.

|

|||||

|

FROZE-ACCOUNT | Jan 10, 2024 Account was frozen (over 400K) after they confused our account with another account / person whose name was not even very similar. We were treated like dirt after 12 years and "Guilty until Innocent". I ha... Read More |

|||||

|

|

3.50% |

$50 |

Learn More | ||

|

Money Market Account. Bank does not offer ACH processing; customers need to initiate ACH externally.

|

|||||

|

65JimmyJay | Dec 12, 2022 Developed buyers remorse after they stopped raising the rate and switched to Brilliant. |

|||||

|

|

3.48% |

$25,000 |

Learn More | ||

|

Requires checking account.

|

|||||

|

James A. Elder | Mar 25, 2020 I was told on the phone by a bank rep that my present money market acct interest rate would continue at 2.25% until June 30, 2020 and would be FDIC covered up to $250,000. Please verify if this is true???... |

|||||

|

|

3.46% |

$25,000 |

Learn More | ||

|

Indexed money market. Bank reports that this product and rate are available for new customers only.

|

|||||

|

PJs at bedtime | Jun 25, 2022 I've been in and out of igo. I usually carry a large balance when they are rate competitive (half the time) and move by money somewhere else when they aren't (the other half). The $3,000 transfer limit is ... Read More |

|||||

|

|

3.40% |

$0 |

C | Learn More | |

|

360 Performance Savings Account. Rate available for new account holders only. |

|||||

|

highstream | Jan 2, 2024 Like others, I've been with Capital One and its predecessor ING Direct since 2007. I've also been getting cheap bank rates on my savings account and didn't realize that there was something better, although... Read More |

|||||

|

|

3.40% |

$0 |

Learn More | ||

|

Last change:

↓0.10% on November 26.

|

|||||

|

Dev1ldog | Nov 8, 2023 I see nothing exciting about AmEx Bank. Sign on is a hassle and the rates are adequate. Multiple accounts are not summarized. To cancel maturing CDs require phoning in or snail mail. Above average serv... Read More |

|||||

|

|

3.40% |

$0 |

Learn More | ||

|

Last change:

↓0.10% on October 6.

|

|||||

|

AVOID_ READ_CAREFULLY | Jan 10, 2024 AVOID at all costs. We read the addendum to the final page of the LENGTHY account agreement mailed to us after completing the online portion. Guess what? It gives this sweet seeming Discover Bank access to... Read More |

|||||

|

|

3.40% |

$0 |

Learn More | ||

|

Last change:

↓0.50% on September 22, 2024.

|

|||||

|

norich@aol.com | Mar 19, 2024 I have 5 other cd's at competing banks and have not had trouble. I tried 3 times today to open one w/ bradesco and it repeatedly declines my app after I input the code they sent me. Customer service was no... Read More |

|||||

|

|

3.40% |

$1 |

Learn More | ||

|

Money Market Premier. Bank reports that this rate is for new customers only.

|

|||||

|

Mike Brown | Jul 6, 2023 This is an example of a bad bank. Their online process for purchasing a CD is horrible. You fill it out and it rejects it after all of your private information is disclosed. They there customer service is ... Read More |

|||||

|

|

3.40% |

$1 |

B | Learn More | |

|

UFB High Yield Savings. Bank reports that this rate is for new customers only. |

|||||

|

mi ra | Nov 10, 2025 For all I know it COULD be a good bank... But I cannot see how - was tempted with interest rates, tried to fill out application, had a question so called bank. Trice! Had to hang up after 15 minutes wait. ... Read More |

|||||

|

|

3.35% |

$0 |

Learn More | ||

|

Last change:

↓0.40% on December 22.

|

|||||

|

J Dally | Jun 13, 2023 I'll steer clear of Dollar Savings Direct and My Savings Direct until they guarantee users at both online divisions their best rates. Banks have the right to segment their customers yes, but these games w... Read More |

|||||

|

|

3.35% |

$1 |

Learn More | ||

|

MySavings Account.

|

|||||

|

not perfect but | Apr 25, 2023 with all of these online bank, including the well known ones, delaying transfers forever in order to fund these high rates, this one still executes inbound and outbound transfers immediately. Read More |

|||||

|

|

3.35% 3.25% |

$250,000 $2,500 |

Learn More | ||

|

Last change:

↓0.25% on December 12.

|

|||||

|

Adam Liu | Dec 23, 2025 (It's very urgent, therefore we kindly ask you to forward this message to your CEO. If you believe this has been sent to you in error, please ignore it. Thanks) Dear CEO, This email is from China dom... |

|||||

|

|

3.30% |

$0 |

B | Learn More | |

|

Online Money Market Account. Ally's Online Savings account rate is only 3.75% APY.

|

|||||

|

Rad | Aug 13, 2023 Been a customer for a couple of years now with interesting checking, been a happy customer. They give you a $10 reimbursement on atm fees per statement cycle. They pay you to leave your money there curre... Read More |

|||||

|

Jovia Financial Federal Credit Union Restrictions |

3.30% |

$5 |

Learn More | ||

|

Last change:

↓0.45% on November 13.

|

|||||

|

H | Apr 25, 2021 It has some of the most inept, cold workers. They do not return calls. You have trouble using payments or transactions by phone as they charge you. For months during COVID no hand sanitizer was present ... |

|||||

|

|

3.30% |

$50,000 |

Learn More

|

||

|

Last change: ↓0.50% on November 13. |

|||||

|

|

3.25% |

$0 |

Learn More | ||

|

eMoneyMarket Special. Bank reports that rate is extended for new money only.

|

|||||

|

D R Lineberger | Dec 30, 2018 Garden14 Read More |

|||||

|

|

3.25% |

$0 |

D | Learn More | |

|

Last change:

↓0.25% on September 20.

|

|||||

|

Jenny Kingston | Jun 10, 2024 I guess customer service is in the US (not sure). I'd rather that someone in the Philippines answered though. These people are so poorly trained and ill informed that I do not trust them with my personal... Read More |

|||||

|

|

3.25% |

$1,000 |

Learn More

|

||

|

Last change:

↓0.40% on November 13.

|

|||||

|

|

3.15% |

$1 |

A | Learn More | |

|

james | Nov 18, 2023 bad bank hold your deposit over months without credit in your account, no interest, they don’t want pay you interest , they want your money with 0% interest. Read More |

|||||

|

|

3.10% |

$100 |

Learn More | ||

|

Gaius Gracchus | Mar 22, 2024 Their CD rates are reasonable and their Visa rewards is very good at 2.5% on all purchases up to 10K/month. Their customer service is polite and helpful. However, their IT department must need some serio... |

|||||

|

|

3.09% |

$1,000 |

Learn More | ||

|

Last change:

↓0.16% on December 12.

|

|||||

|

Beenthere | Jan 30, 2024 Have an IRA rollover, they don't take IRAs any longer. |

|||||

|

|

3.04% |

$100,000 |

Learn More | ||

|

Last change:

↑0.04% on December 15, 2023.

|

|||||

|

HonestReview | Apr 19, 2023 This bank was honest and I had no problems with them in person. Not everyone was equally competent but they got help. |

|||||

|

|

3.03% |

$100 |

Learn More | ||

|

Last change:

↓0.93% on September 13.

|

|||||

|

BW | Jul 17, 2021 I've been with this bank for 6 months and have not had any problems. Bill pay works good. The 24 month investing CD is another vechile I use. Rates are above average considering the national rate. I'd reco... Read More |

|||||

|

|

3.00% |

$1 |

B | Learn More | |

|

Last change:

↓0.25% on October 6.

|

|||||

|

NRB | Mar 14, 2018 Poor service. Condescending attitude. Savings application denied without giving reason (Equifax file had a freeze because of hacking history) and not advising customer of need to unfreeze credit file for a... Read More |

|||||

|

|

3.00% 2.50%2.00% |

$250,000 $100,000$25,000 |

Learn More

|

||

|

Last change: ↑2.00% on November 21, 2024. |

|||||

|

|

3.00% 2.50% |

$250,000 $0 |

Learn More

|

||

|

Last change:

↓0.25% on September 9.

|

|||||

|

|

2.75% |

$1,000 |

Learn More | ||

|

Last change:

↓0.25% on November 17.

|

|||||

|

JohnC | Oct 11, 2020 You probably thought - as did I - that you were looking at a site that belongs to and was the responsibility of Gateway First. After all it includes their headings, selected financial statements, many pag... Read More |

|||||

|

|

2.70% |

$5 |

Learn More | ||

|

Last change:

↓0.10% on November 14.

|

|||||

|

Rob | Dec 25, 2023 I joined in PENFED in Spring Of 2023 after 15 yrs of belonging to one of the banking giants. I found my accounts dwindling fast unexplained decreases. I decided to close the account but had to return a mer... |

|||||

|

|

2.63% |

$250,000 |

D | Learn More | |

|

Beenthere | Jan 29, 2024 Tried to enter information on line to open a 5 year CD, multiple time and wasn't accepted. Talked to a live person who was of no help at all. My credit score is over 800 and I have plenty of money in oth... Read More |

|||||

|

|

2.60% 1.90% |

$100,000 $50,000 |

Learn More

|

||

|

Last change:

↓0.20% on December 15.

|

|||||

|

|

2.28% |

$250,000 |

Learn More | ||

|

Last change:

↓0.15% on December 15.

|

|||||

|

nonsense | May 21, 2021 avoid this Read More |

|||||

|

|

2.25% |

$0 |

A |

Learn More

|

|

|

Last change:

↓0.10% on February 3.

|

|||||

|

|

2.05% 1.85% |

$1,000,000 $500,000 |

Learn More | ||

|

Last change:

↓0.10% on December 15.

|

|||||

|

Amanda Frank | Feb 25, 2023 HORRIBLE SERVICE. My son's campus checking account was hacked and over $9000 was stolen. Fraud department was impossible to reach and we waited on phone several days for over 2 hours at a time. They too... |

|||||

|

|

2.00% |

$0 |

B | Learn More | |

|

Last change: ↓0.25% on March 6. |

|||||

|

mcriss | Oct 23, 2023 Synchrony Bank recently closed 3 of my accounts with them and this decision was completely unwarranted. I had two Guitar Center cards and one Levin Furniture card. I found out about this through a push not... Read More |

|||||

Best Online Savings Account Rates

- A competitive interest rate. BestCashCow maintains the most comprehensive list of deposit account rates. The rates above are the best available rates for online savings accounts. In order to ensure that your money continues to grow over time, you may wish to avoid banks which rely heavily on very short term promotional rates (such as EverBank). If you open an account with a promotional rate or even if you open an account where the rate isn’t promotional in nature, you should check back with BestCashCow regularly to be sure that your bank continues to offer one of the most competitive rates.

- Full functionality through online and mobile access. Most of the accounts listed above have robust websites and mobile access that enables full functionality. Read the comments from other users before opening an account as they often highlight problems with access.

- Assess how the bank provides customer service. Many of the leading online banks now have customer service representatives who are U.S. based and available 24/7 with low wait times. This is often a distinguishing feature that makes a well-recognized bank significantly more attractive than a smaller bank trying to enter the online banking arena.

- Absence of fees. Be sure that you are opening an online account with a bank that doesn’t charge fees and has very low minimum balance requirements. American Express, CIT, GS Bank, Barclays and Ally are all well known for low minimum requirements and the absence of any unusual monthly fees.

- Easy Access to your Cash through Immediate Online Transfers. The reason why you keep money in savings is for access in an emergency or to take advantage of immediate financial opportunities. You need access to your cash. Yet, some banks impose strict limits on the amount of cash that you can access from your account in a single transfer or limit the numbers of transfers you can conduct over a given time period. Other banks can delay your transfers for days while they make money on the float. You should check with the bank where you are considering opening an online account to understand the restrictions before you open an account. You may also read the comments from other users above as they can highlight which banks enable the best access to your cash.

- Stay within FDIC limits! See the section above and read this article.

- Use the BestCashCow Savings Calculator to see how important it is to be maximizing your interest on savings accounts over time.

Why You Can Trust BestCashCow

Every year, Americans collectively lose at least $80 billion in income just by putting their savings in the wrong bank accounts. BestCashCow is the most comprehensive and unbiased bank rate site on the Internet and our mission is to help you to avoid your share of these losses. We monitor over 30,000 rates from over 8,000 FDIC-insured banks and 7,700 NCUA-insured credit unions. Take a few minutes to explore the table above to see the best savings rates currently offered by online banks, or use the tabs to explore local bank rates or local credit union rates if your prefer to do your banking locally.

By using BestCashCow to move your money to a new bank from one with a low savings rate you may be able to boost your annual interest earned from savings by more than 10X. Banks are always competing for your money. Take advantage of it!

You can learn more about BestCashCow here.

Written by

Written by  Edited by

Edited by