1. Understand why you want to buy a vacation home

- How much time will you realistically spend there?

- How far away is the vacation home? Is it easy for you (and your family and friends) to visit frequently? When during the year will you spend time there?

- Have you spent time there before? Is it a place you love?

- Vacation homes generally do not make the best investments. And they can be hard to sell. Buying a vacation home makes sense if you are buying it for your enjoyment. If you frequently visit the same place, multiple times a year, year over year, then owning a vacation home in that place may make better financial sense than renting a place or staying in a hotel each time you visit.

- Do you plan to rent the property when you aren’t there?

- Rental income can help offset the costs of owning and maintaining a vacation home, but also brings risk of loss and damage.

- How will you manage the property when you aren’t there? Is there a reliable, responsible property management service available?

2. Work with an experienced agent who knows the area well.

Agents who know the area well can help you find the best property to meet your budget and vacation desires. They also understand the ins, outs, ups and downs of the market, can provide guidance in terms of making a successful offer, and help you identify property managers and other resources.

3. Budget realistically

- Be sure you can truly afford your desired vacation home. When creating your budget, include maintenance, insurance, utilities, taxes, HOA fees, property management fees, etc. If you plan to rent your vacation home when you aren’t using it, be conservative in estimating rental income in your budget.

4. Understand the tax implications

- If you have a mortgage on your vacation home, you may be able to deduct the mortgage interest and real estate taxes for your vacation home using Schedule A.

- Alternatively, if you rent your vacation home at least 15 days per year, you may be able to deduct mortgage interest, real estate taxes, maintenance, depreciation, etc. from your rental income using Schedule E.

- Check with your accountant or CPA to fully understand the tax implications and requirements specific to your situation.

5. Financing a vacation home is different than financing a primary home

- Be prepared for higher rates than that for your primary home

- Rates may be about the same as you can get on your primary home, but you should always be prepared for a higher rate. Second homes often introduce additional risk to the loan, which leads to higher rates to offset the risk.

- Property requirements vary by loan type, but typically include at least some of the following:

- Must be located a reasonable distance away from the borrower’s primary residence.

- Must be occupied by the borrower for some portion of the year.

- Must be suitable for year-round occupancy.

- The borrower must have exclusive control over the property.

- Must not be rental property or a timeshare arrangement.

- Cannot be subject to any agreements that give a management firm control over the occupancy of the property.

- May not belong to a rental pool

- Rental income (from the subject property second home) cannot be used to qualify the borrower

- Property type makes a big difference in regards to your financing options

- When buying a single family home for your vacation home, you have the most options – similar to buying a primary residence

- When buying a condo or condotel, there are fewer options and more requirements for the available options

- What is a condotel you ask? A condotel is a condo building that has a registration desk, a “rental pool” and central management of rentals, and offers nightly rates for the units. Condotel’s are not subject to management and rental pool restrictions typical to most second home financing programs. Condotel’s are sometimes referred to as “resort condos”.

- Financing a condotel can be difficult.

- Many lenders do not have loan products for condotels. Before you get too far along in the buying process, be sure that your lender can support the loan. In many cases, particularly in beach resort areas, specific programs are set up by local lenders.

- Even when a lender does have a condotel product, the loan guidelines may not meet your needs. For example, there may be a minimum down payment amount or minimum/maximum loan amount to consider.

- If your condo building does not have a registration desk, nightly rentals, and most residents live there full time, then your condo likely qualifies for standard condo loan programs, which are very similar to buying a single family residence. The key differences in buying a condo are the need for the condo management or HOA to complete a “condo questionnaire” and provide documentation and meet guidelines for insurance. So, more guidelines and paperwork, but many financing options are typically available.

- The treatment of rental income for investment properties is different than for a second home

- Rental income from the property cannot be used to qualify for a conventional loan

- “Personal use” days must be greater than 14 days or 10% of the days available for rent at a fair price. If your personal use days are less than 14 days or 10% of available days, then the property is considered an investment property

Buying a vacation home is supposed to improve your future vacations! If you find a home that meets your vacation needs and fits your budget, and you are realistic about the financing process, then you should have an enjoyable experience.

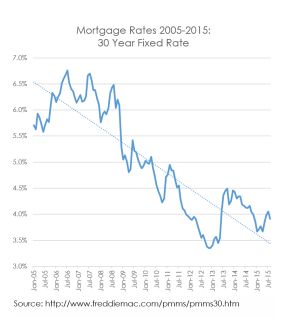

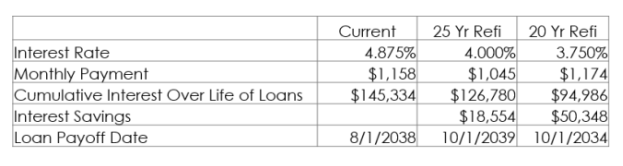

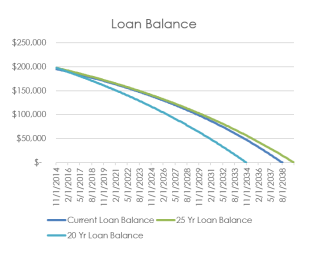

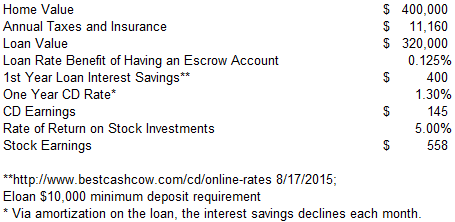

Interest rates remain at historic lows, so for many who haven't refinanced their mortgage recently or have a current mortgage rate above 4.5%, refinancing may be a great financial decision. But how does one determine if now is the right time to refinance?

Interest rates remain at historic lows, so for many who haven't refinanced their mortgage recently or have a current mortgage rate above 4.5%, refinancing may be a great financial decision. But how does one determine if now is the right time to refinance?

his mortgage loan interest rate by 0.125% to encourage him to use an escrow account.

his mortgage loan interest rate by 0.125% to encourage him to use an escrow account.