BestCashCow provides the Texas Ratio for every bank and credit union on BestCashCow. To find it, go to any bank and credit union and click on the Financial Details tab. What is the Texas Ratio and what does it show about a bank or credit union's health?

The Texas Ratio helps assess the health of a bank. It compares the amount of loan risk a bank has by the amount of reserves and capital a bank has at its disposal to cover those losses. Let's take a look at a simplified example. Suppose you had lent $100,000 to five friends and two of the friends were late paying you back. That means that $200,000 that you put into loans is at risk. You don't know if your friends will be able to pay the loan back. Now suppose you have set aside $100,000 in anticipation of one friend defaulting and you have another $100,000 in savings. That means that you have $200,000 at risk and $200,000 to cover these losses. That would give you a Texas ratio of 100% ($200,000/$200,000)*100.

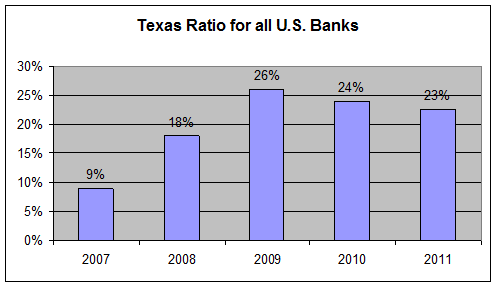

The concept with banks is the same. Calculating the Texas Ratio for banks means taking the amount of delinquent loans, adding the amount of owned assets, which include repossessed cars, foreclosed homes, etc. and then dividing this by the amount of reserves a bank has set aside to cover bad loans and the amount of capital a bank has available. So if a bank has a Texas Ratio above 100%, it has just enough reserves and capital to cover potential bad loans. A Texas Ratio over 100% means a bank does not have enough to cover delinquint loans if they go bad. The average Texas Ratio for all banks has varied between 9-26% over the last five years. That means that on average, banks have between five to ten dollars of reserves and capital for every dollar of potential bad loans.

Generally, not all delinquint loans go bad, and banks are able to sell property they have foreclosed on, so usually while a Texas Ratio of 100% is a warning sign, it's not a signal of impending trouble. Ratios above 200% though are big warning signs. Let's look at the Texas Ratio of some recently failed banks.

Closed Bank Texas Ratio

Atlantic Bank and Trust 752.44%

McIntosh State Bank 696.94%

Community First Bank 206.85%

North Georgia Bank 732.82%

American Trust Bank 571.69%

All of the banks on BestCashCow are FDIC insured and almost all of the credit unions are NCUA insured, so why does this matter? There are several ways that bank failures can impact consumers:

- A depositor may lose some or all of the money above FDIC limits if a bank fails.

- Any CD or CD IRA which a consumer holds in a failed bank may be reset once the bank’s assets are transferred to another bank or cashed out by the FDIC. For example, a depositor who holds a 5-year CD paying 6% APY from 2007 might find the CD called, resulting in lost interest.

- Failing banks may not have the time and money needed to provide top-notch customer service and support. They are fighting for their survival.

- The cost of bank failures is ultimately borne by the consumer. Money spent by the FDIC to insure bank deposits comes from a fee levied on all banks. The fee that a bank pays, is passed through to the consumer in the form of higher account fees, bank charges, and interest rates on loans. Ultimately, if the bank failure is big enough or systemic enough, the general public must come up with the funds to bail out the banks, as with the TARP and the S&L bailout in the 1980s.

And contrary to what many people think, BestCashCow research shows that distressed banks (banks with high Texas Ratios) do not offer higher rates. In fact, the opposite seems to be true.

To find the Texas Ratio for any bank or credit union, click the Financial Details tab on that institutions BestCashCow page.