Looking for the safest banks in the country? According to data from BestCashCow, you should look to New England. Along with snow, steepled churches and the New England Patriots, the New England states have the safest banks based on average weighed Texas Ratios. Georgia takes last place with the dubious distinction of having the least safe banks in the fifty states. Using data from the FDIC, BestCashCow calculated the Texas ratio for each state using data from banks with assets under $10 billion. The Texas Ratio compares the amount of loans at risk and the amount of owned real estate with the amount a bank has on hand to cover any losses. While it is not a definitive guide to bank risk and soundness, it has been found to be a good indicator in the past.

If you look at the Texas Ratio of some recently failed institutions you can see that high numbers are an indicator of bank stress:

Closed Bank Texas Ratio

Community First Bank 206.85%

North Georgia Bank 732.82%

American Trust Bank 571.69%

The average Texas Ratio for all FDIC insured banks as of December 31, 2010 is: 24.44%

So, how did each state fair? The chart below shows the Texas Ratios for each state. Lower Texas Ratios are better.

|

Texas Ratio

|

State

|

|

9.769899

|

RI

|

|

10.31442

|

VT

|

|

11.24753

|

MA

|

|

11.39952

|

NH

|

|

11.58348

|

AK

|

|

11.98403

|

ND

|

|

12.74567

|

NE

|

|

15.20141

|

PA

|

|

15.55923

|

WV

|

|

16.07008

|

IA

|

|

16.35404

|

NY

|

|

16.50772

|

CT

|

|

17.25679

|

ME

|

|

18.80798

|

OK

|

|

19.0405

|

WY

|

|

19.58247

|

TX

|

|

20.11829

|

NJ

|

|

21.31649

|

KY

|

|

21.71634

|

SD

|

|

22.60318

|

IN

|

|

22.62987

|

NV

|

|

22.66439

|

UT

|

|

24.46261

|

MS

|

|

24.59149

|

VA

|

|

25.43843

|

OH

|

|

27.62091

|

CA

|

|

27.6219

|

KS

|

|

28.33767

|

MO

|

|

29.1839

|

MT

|

|

29.25415

|

AR

|

|

30.6982

|

LA

|

|

31.32479

|

TN

|

|

32.71303

|

WI

|

|

33.33595

|

AZ

|

|

33.93491

|

AL

|

|

34.04053

|

HI

|

|

34.15069

|

MI

|

|

34.65609

|

MN

|

|

35.79779

|

IL

|

|

35.94066

|

DE

|

|

37.01124

|

MD

|

|

37.30069

|

DC

|

|

37.93968

|

ID

|

|

41.14497

|

NM

|

|

45.2706

|

OR

|

|

47.94945

|

WA

|

|

49.67615

|

NC

|

|

50.12035

|

CO

|

|

51.09658

|

SC

|

|

51.80468

|

FL

|

|

78.90731

|

GA

|

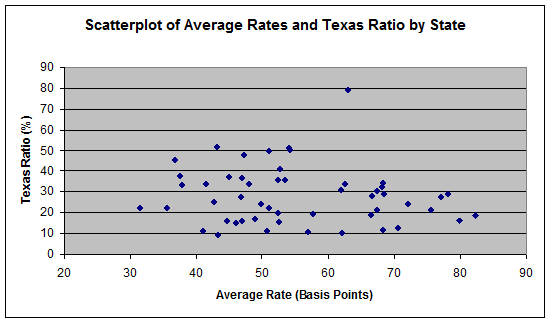

Rhode Island claimed the top spot as the safest state with a Texas Ratio of only 9.77%, followed by three other New England states – Vermont, Massachusetts, New Hampshire. Georgia claimed the bottom spot with a Texas Ratio of almost 79%. Florida came in second from the bottom at 52%, and South Carolina came in third at 51%.

This data matches up well with past bank failures. According to FDIC data, the New England states combined saw only one bank failure between 2008-2011, in Massachusetts. Georgia alone saw 57, the most in the country. Florida was second with 47. New England banks have been safe and look likely to stay that way into the future.

Why Does New England Have Safer Banks?

In general, states with low Texas Ratios have banks with a low percentage of non-performing loans. All New England states were in the top 15 for the best non-performing loan to assets ratio with none of the states above 2.02%. Georgia had a non-performing loan ratio of 8.47%. New England states had also had more capital on their balance sheets, with only Vermont having a capital ratio of less than 10%.

“New England banks have fewer bad loans on their books and more capital to protect against future bad loans,” said Sol Nasisi, Chief Economist of BestCashCow.com. Interestingly, they also have lower loan loss reserves (money set aside to offset bad loans) because they anticipate fewer problem loans.

|

State

|

Texas Ratio

|

Texas Ratio Rank

|

Non-performing as % of Assets

|

Nclns as % of Loans

|

Equity Capital to Assets

|

Loan Loss Reserves to Assets

|

|

Georgia

|

78.90%

|

50

|

8.47%

|

13.22%

|

9.07%

|

1.66%

|

|

Colorado

|

50.12%

|

47

|

5.35%

|

9.05%

|

8.81%

|

1.88%

|

|

Washington

|

47.95%

|

45

|

5.91%

|

9.09%

|

10.53%

|

1.81%

|

|

Oregon

|

45.27%

|

44

|

5.43%

|

7.96%

|

10.27%

|

1.72%

|

|

Texas

|

19.58%

|

16

|

2.33%

|

4.15%

|

10.93%

|

0.98%

|

|

Rhode Island

|

9.77%

|

1

|

1.19%

|

1.80%

|

11.29%

|

0.89%

|

Why the Regional Differences?

So, why do New England banks have such a better loan portfolio? The data suggests a combination of factors:

- Slower Population Growth. States with lower Texas Ratios generally have lower population growth rates based on US Census data. The inverse is also true. A growing population translates into a more speculative environment, and laxer lending standards. For example, Georgia was the fourth fastest growing state between 2000-2009. Flordia was #9 and South Carolina #10. Rhode Island by comparison was the second slowest growing state in the country behind Michigan.

- Lack of New Bank Formation. This goes hand-in-hand with low population growth. States with stable populations saw very little new bank formation while growing populations generally saw the most new bank formation. Since 1995, Florida saw the second largest numbers of new banks formed (144) while Georgia was #3 on the list (103). California was #1 at 146 new bank formations. In comparison, Rhode Island was 40th in new bank formations during this same period. New banks may be overly aggressive building up their loan portfolios or may not have the experience or systems in place to prevent risky lending.

- Lending and Oversight. Banks in some states just did a better job lending money, probably in concert with more effective regulatory oversight. While Texas is #6 in population growth and had the fourth greatest number of bank start-ups since 1995, its Texas Ratio is in the bottom half of all states. Texas has done a better job managing its banks than many other fast-growth states. A fast-growing state with a lot of young banks does not need to translate into a slew of bank failures if the banks are well run and well regulated.

Consumer Implications

All of the banks covered in this analysis are FDIC insured which means that in any state, regardless of the Texas Ratio, depositors who stay within FDIC limits will not lose money. So why does this all matter? But there are several ways that bank failures can impact consumers:

- A depositor may lose some or all of the money above FDIC limits if a bank fails.

- Any CD or CD IRA which a consumer holds in a failed bank may be reset once the bank’s assets are transferred to another bank or cashed out by the FDIC. For example, a depositor who holds a 5-year CD paying 6% APY from 2007 might find the CD called, resulting in lost interest.

- Failing banks may not have the time and money needed to provide top-notch customer service and support. They are fighting for their survival.

- The cost of bank failures is ultimately borne by the consumer. Money spent by the FDIC to insure bank deposits comes from a fee levied on all banks. The fee that a bank pays, is passed through to the consumer in the form of higher account fees, bank charges, and interest rates on loans. Ultimately, if the bank failure is big enough or systemic enough, the general public must come up with the funds to bail out the banks, as with the TARP and the S&L bailout in the 1980s.

While bank failures are always about an individual institution, state averages show that in some states, bank regulators and management have further work to do to protect depositors and taxpayers.