The Federal Reserve raised the Fed Funds rate by 25 bps to a target of 1.75% to 2% this afternoon. The move marks the seventh such move since the Fed began moving the Fed Funds rate from zero in December 2015, and the second in Jay Powell’s tenure as Chairman. Barring some sort of dramatic and unforeseen development it won't be the last raise.

The Fed’s language became more hawkish with the Fed raising median outlook for 2018 since it last meeting. The Fed is now guiding towards two more rate hikes (instead of 1) before the end 2018 (for a total of 4 versus 3 hikes in 2018). While the long-range Fed funds forecast remains at 2.90%, the Fed funds rate is now forecast at 3.125% at the end of 2019, and 3.375% at the end of 2020.

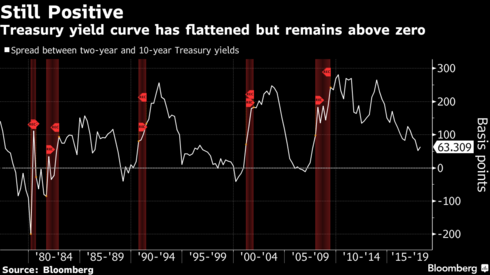

Against this backdrop, BestCashCow continues to find savings and money market accounts and short-term CDs substantially more attractive than longer-term CDs and bonds.

Here are five products worth taking a look at:

- CIT Bank Online Money Market – 1.85%

CIT Bank has been around for a long time, and is generally very positively reviewed on BestCashCow. Over the years, they have always been faster to move their savings and money market rates than others, and their savings rate is currently one of the highest. With only $100 required to open an account, CIT works for just about everyone.

- CIT Bank 11-Month No Penalty CD – 1.85%

If you are a contrarian and believe that savings rates may fall over the coming year, or have seen enough over the last decade that you want to protect yourself from that unlikely eventuality, CIT Bank is also offering a solution for you in the form of an 11-Month No Penalty CD.

While this product pays the same as CIT’s online money market account, it guarantees that it will pay that amount for almost a year. In the meantime, it can be terminated and moved to the money market account at any time and without penalty. With this product, CIT is essentially offering depositors a free option.

Radius Bank is a new entrant to the online savings arena, but seems to be committed to making it work. The 1.86% online savings rate is only good for depositors who bring $25,000 or more; the bank is worth a look as this account can be easily partnered with a high interest checking account packed with features that can enable depositors to migrate virtually all of their branch banking to online banking.

Editor’s Note: Radius Bank is an advertiser on BestCashCow. Please read our Advertiser Disclosure here.

- Purepoint Bank Online Savings – 1.90%

Purepoint has to be listed here because they currently have a 1.90% online savings rate. However, Purepoint may not work for everyone as they haven’t always been so fast to raise their rates and they may be focused more on trying to build out a branch network.

While the direction of rates is clearly up, there is little risk in locking some money that you won’t need into a one-year CD, and there may even be a small upside. Marcus, the online banking division of Goldman Sachs, has recently raised all of their CD rates and is now offering a 2.30% one-year CD. Marcus is well reviewed by BestCashCow users, and as we noted in our May 2018 note, Goldman Sachs’ ownership and commitment to the space makes it a good and a safe place to do your baking business.

Editor’s Note: Marcus is an advertiser on BestCashCow. Please read our Advertiser Disclosure here.

Rates can change. See the latest online savings and money market rates here. See the latest online one-year CD rates here.