Is adding a TIPS to your portfolio a good idea? Most investment advisors will tell you yes, of course it’s a good idea. But that’s not necessarily true. For the sophisticated investor, the decision to do so depends on your personal view of the economy and future inflation expectations. It also depends on what you think will happen with the budget talks in Washington and the US’s ability to rein in its massive Federal debt. Lastly, it depends on how others view the same prospects.

TIPS were created as a means to help safeguard and preserve consumer buying power in times of upward inflationary pressure on prices. The Bureau of Labor Statistics publishes the CPI-U mid-month and it is used to adjust – up or down – the TIPS principal on a semi-annual basis.

If you are new to TIPS or want some general information, see our TIPS primer. TIPS can be purchased from the U.S. Treasury online and at many banks across the country in increments of $ 100 for terms of 5, 10 or 30 years. They may be purchased by individuals, estates, trusts, partnerships or corporations.

To briefly summarize, the yield on a TIPS is determined in auction. Below are the latest auction results for various TIPS terms.

11/30/2011 – 10 Year Re-auction Yield: .099%

10/31/2011 – 30 Year Re-auction Yield: .999%

9/31/2011 – 10 Rear Re-acution Yield: .078%

8/31/2011 – 5 Year Re-auction Yield: -0.825%

7/29/2011 – 10 Year Auction Yield: 0.639%

All 10 Year TIPS listed above have gone out at interest rates of .625% (the interest rate is the listed price on the security, not the yield, which changes based on the underlying price of the security). This interest rate is fixed for the life of the security. What changes is the principal value of the TIPS based on the auction and also on the inflation adjustments.

Notice how some TIPS yields are negative. There are reasons why investors would purchase a security at a negative yield.

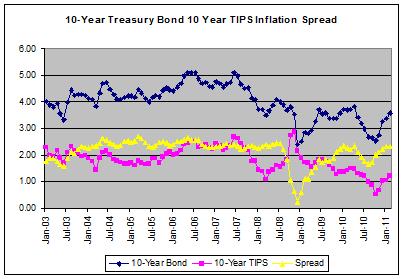

The US’s safe haven status has continued to depress US bond yields, including TIPS. The decision on whether to invest in TIPS depends on the premium between a TIPS and a regular Treasury bill, note, or bond of the same maturity. For example, the TIPS/Treasury spread for 10 Years is currently:

10 Year Treasury Yield: 1.95%

10 Year TIPS Yield -0.90%

Difference: 2.85%

If you think inflation over the next 10 years will average more than 2.85% then it is better to buy a TIPS. If not, it is better to purchase 10 Year Treasuries. Interestingly, this difference has widened from 2.29% back in April 2011, indicating that inflation expectations have grown as the yield on 10-Year TIPS has dropped from -0.18% to -0.90%. This is a sign that investors believe economic growth will strengthen.

This is important. TIPS will only outperform vanilla Treasuries when future unexpected inflation occurs. Otherwise, inflation expectations are already priced into the value of a plain Treasury security.

While I thought that a 2.85% CPI-U would be a pretty easy bar to cross, it’s not a slam dunk. Since 1913, the annual percent change in the CPI-U has been 3.03%. If we start in more modern times, then the average percentage increase rises to 3.82%. The graph visually shows the trend and how the 2.85% compares.

So, back to the original question. Does it make sense to purchase a TIPS? In general, TIPS are a good insurance policy should we ever get the bad inflation of the 1980s or even worse, should the politicians fail to solve the country’s long-term budget problems and we get hyper-inflation. Right now, the bond markets don’t see inflation pressures, but the markets are not clairvoyant and a TIPS makes sure you are protected from unexpected inflation surprises.

Thomas Hertog assisted in the writing of this article.

Comments

Altier

December 15, 2011

Don't really understand. How is it possible TIPS yield can be negative?

Is this review helpful? Yes:0 / No: 1

Add your Comment

use your Google account

or use your BestCashCow account