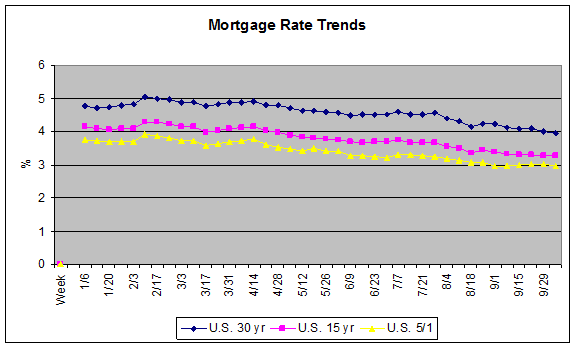

Most mortgage rates followed bond yields higher this week. Freddie Mac today released the results of its Primary Mortgage Market Survey® (PMMS®) in which the 30-year fixed-rate mortgage (FRM) averaged 4.81 percent with an average 0.7 point for the week ending December 10, 2009, up from last week when it averaged 4.71 percent. Last year at this time, the 30-year FRM averaged 5.47 percent.

The 15-year FRM this week averaged 4.32 percent with an average 0.6 point, up from last week when it averaged 4.27 percent. A year ago at this time, the 15-year FRM averaged 5.20 percent.

The 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 4.26 percent this week, with an average 0.5 point, up from last week when it averaged 4.19 percent. A year ago, the 5-year ARM averaged 5.82 percent.

The 1-year Treasury-indexed ARM averaged 4.24 percent this week with an average 0.7 point, down slightly from last week when it averaged 4.25 percent. At this time last year, the 1-year ARM averaged 5.09 percent.

(Average commitment rates should be reported along with average fees and points to reflect the total cost of obtaining the mortgage.)

"Following an upbeat employment report, long-term bond yields rose slightly and fixed mortgage rates followed," said Frank Nothaft, Freddie Mac vice president and chief economist. "The economy shed only 11,000 jobs in November, far fewer than the market consensus forecast, and the unemployment rate unexpectedly fell to 10 percent. In addition, revisions added 159,000 jobs to September and October."

"Notwithstanding, rates on 30-year fixed mortgages are almost 0.7 percentage points below those at the same time last year. This translates into an $81 lower monthly payment on a $200,000 conventional mortgage."

Add your Comment

use your Google account

or use your BestCashCow account