Following the stock market’s incredible collapse in March and subsequent recovery, my inbox has been inundated with emails from readers writing to tell me that they are now 90% to even 100% in cash.

These emails come from people young and old, rich and poor, optimistic in their tone and pessimistic in tone. Some include racist, conspiratorial rants as part of their justification. Others are more rational.

I am not 100% in cash or even close. I maintain a healthy portfolio of major pharmaceutical stocks and biotechs. I own major technology stocks that I have no intention of selling. But, outside of those sectors, my only exposure to equities is through Berkshire Hathaway.

Stock markets today are dramatically overvalued. The S&P is trading at a trailing P/E of 20x. While trailing earnings or even current earnings are not the only way to value a stock or an index, the other mechanisms take into account earnings growth and leverage. Earnings will be down dramatically across the board in 2020 and probably into 2021, and the market is highly leveraged. Therefore, there simply is no more favorable metric than the P/E ratio right now.

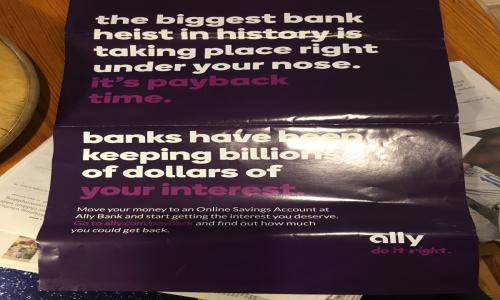

The problem with savings and money market accounts as a place to hang out is clear. The longer that the Federal Reserve maintains the target Fed funds rate at zero to 0.25% (or lower), the more likely we are to see savings rates fall. Over the last two weeks, virtually every major online bank lowered its savings rates by 20 basis points and it is increasingly difficult to get more than 1.30% on your savings.

Some have suggested that the outcome of the COVID-19 crisis will be a prolonged period of deflation in the US. If we do enter a period of deflation, cash could be the single best asset to hold since it will maintain its real value ($1 tomorrow will be worth more than $1 today and commercial banking will never take your money and give you back less).

I personally do not see asset deflation in an era where the Federal government will be unable to have a balanced budget and where leverage rates are likely to need to remain very high throughout the public and private sectors.

In an environment where prices are increasing by more than what you are earning in a savings account, maintaining your money in savings accounts may not be a reliable intermediate or long-term strategy for maintaining value and purchasing power.

Savings accounts are calming and are a great place to hang out for short periods of time when the economy is going through a massive transformation. The ability to earn a higher rate of return and maintain complete liquidity makes online savings accounts particularly interesting during this period. But, people need to think a little more creatively about maintaining the real value of their money and that may involve investing in commodities such as gold, real estate, some equities and short or long term CDs.

Add your Comment

use your Google account

or use your BestCashCow account