Occasionally, financial planners reach out to me and want to connect on LinkedIn and social media. While I do not hold financial planners in very high esteem since, they are always selling their latest product. I occasionally connect in order to further the reach of BestCashCow.

I do not often engage in debate with these folks, but sometimes I see information shared that is so dangerous to investors and their retirement planning that I need to say something.

That happened this morning with this Wall Street Journal piece: https://blogs.wsj.com/experts/2019/01/06/how-to-play-the-bond-market-during-a-bear-market/

As dangerous as individual bonds may be, they are in principle much less dangerous than owning a bond fund, even a high quality bond fund, since you can always just hold a bond until maturity without having your proceeds drained by a manager in a down environment. At maturity, you get out at par, whereas you may never get out of a bond fund at par.

The 10-year US Treasury went to 3.20% last year. As interest rates rose, bond prices fell. Market turmoil over the last 2 months has lead people to seek safe haven in bonds and that has brought US Treasury rates back to 2.60%. But, this is a blip. It is a fleeting moment where you should be selling bonds and bond funds. It isn’t a time to buy. The Federal Reserve is still normalizing interest rates and in that environment the 10-year is still going up.

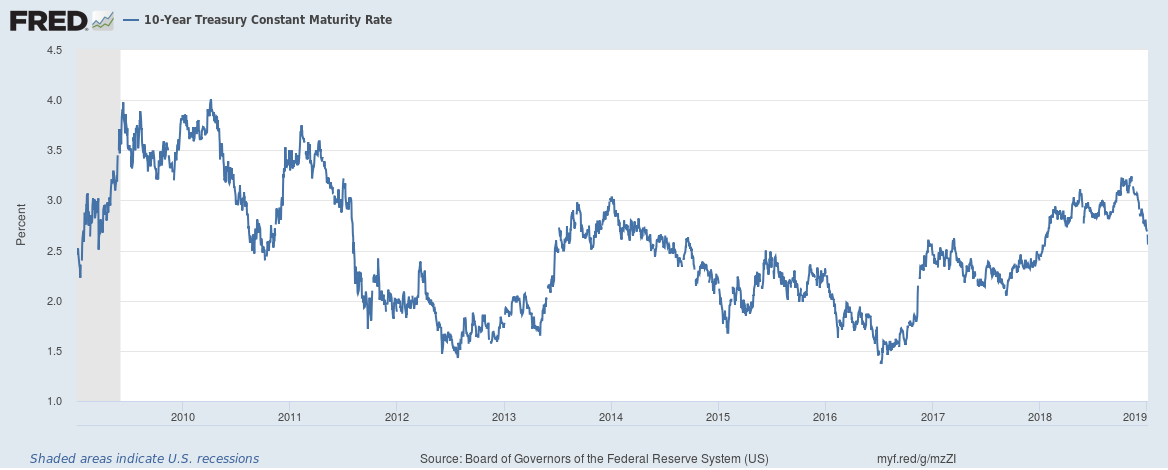

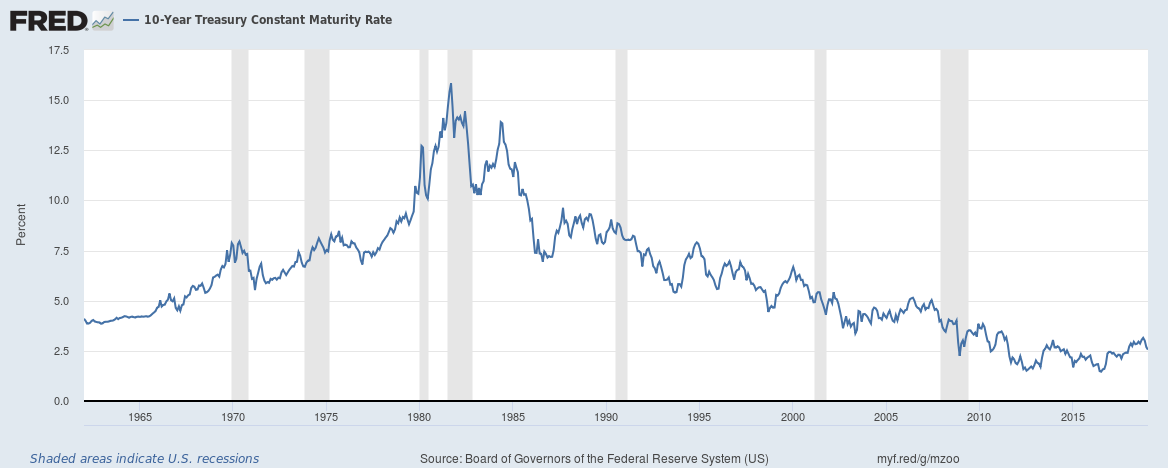

These two graphs from the St. Louis Fed are the best warning I can give. The first, that dates back to 1960, shows how abnormally compressed the 10-year Treasury is by any long-term measure. The second, dating back only 10 years, shows how quickly 10-year US Treasury rates can reverse and rise (even in an environment where interest rates are low).

The “buy bond funds” crowd came out of the woodwork in dramatic fashion in mid-2010 as the 10-year fell from 4.00% to 2.50%. Those who followed this advice saw their funds collapse when interest rates reversed and were in a world of pain in January 2011. While those folks found some opportunities to get out later, opportunities which buyers today may not get.

Stick with savings accounts and short-term CDs for now.