Like many seemingly simple questions, the answer to the question "should I use an escrow account for my taxes and insurance or manage it myself" is "it depends".

In case you aren't familiar with escrow accounts, let's start by defining it. An escrow account is an account separate from but connected to a mortgage loan account where a deposit of funds occurs for payment of certain conditions that apply to the mortgage, usually property taxes and insurance. Generally, the annual amounts of taxes and insurance are divided by 12; this 1/12th amount is added to your monthly mortgage payment and deposited into the escrow account. Then, on the due dates for your tax or insurance payments, the mortgage loan servicer pays your taxes and insurance from the escrow account. Example: let's say your taxes are $12,000 per year and your insurance is $1200 per year. Divided by 12, your monthly escrow contribution would be $1100.

When you select to have an escrow account, generally this account must be partially funded at the time of your mortgage loan closing - three months is the norm. This means that the cash you must bring to the closing includes your down payment, closing costs, and the escrow funding amount.

Many loan types, such as an FHA loan, require an escrow account, as do most loans when you put down less than 20% of the home sales price. Some lenders offer mortgage loan rate discounts if you agree to an escrow account.

Your personal financial situation and habits play a role in the decision as well: Do you earn the same amount of salary each month or do you have variably monthly income (i.e. commission based)? Are you a good saver? Do you prefer to have ultimate control over every penny and every bill or do you prefer having the loan servicer manage bill payment for you?

For those with variable income, who are good savers, or who like control over every penny and bill, it may make more sense to manage the tax and insurance payments on their own, without an escrow account. For those who prefer to have someone else manage paying the various entities (county, city, school district, insurance company, etc.) or a consistent cash flow, an escrow account may be preferable.

The last consideration is whether or not the money you use to pay annual bills can work for you during the year.

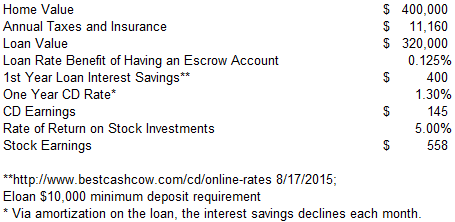

Example: David has purchased a home worth $400K, with a 20% down payment for a loan value of $320K. His insurance and taxes are $11,160 annually. His lender has discounted  his mortgage loan interest rate by 0.125% to encourage him to use an escrow account.David assesses his options: 1. he can go with the escrow account, 2. he can put that $11K into a CD at 1.3% and earn $145 over a year, or 3. he can put it into the stock market with a goal of earning 5% or $558 over a year. The CD option is not beneficial to David as he would end up "losing" $255 ($400-$145). The stock option may be beneficial to David however, as he could "earn" $158 ($558-$400). However, the stock option has the risks of the market and potentially trading fees.

his mortgage loan interest rate by 0.125% to encourage him to use an escrow account.David assesses his options: 1. he can go with the escrow account, 2. he can put that $11K into a CD at 1.3% and earn $145 over a year, or 3. he can put it into the stock market with a goal of earning 5% or $558 over a year. The CD option is not beneficial to David as he would end up "losing" $255 ($400-$145). The stock option may be beneficial to David however, as he could "earn" $158 ($558-$400). However, the stock option has the risks of the market and potentially trading fees.

Still not sure? Your mortgage lender can help you assess the pros and cons for your specific loan and situation.

Add your Comment

use your Google account

or use your BestCashCow account