A new report from Fannie Mae indicates that many U.S. mortgage shoppers are leaving thousands of dollars on the table when they apply and close a mortgage. Data from Fannie Mae’s November 2012 National Housing Survey Topic Analysis Report suggests that consumers could save money and find a more suitable mortgage product if they shopped more effectively and took the time to research different lenders and rates. This confirms a report issued by the Deparment of Housing and Urban Development which suggested that borrowers who obtained multiple quotes from mortgage lenders could save $1,000 or more on closing costs alone.

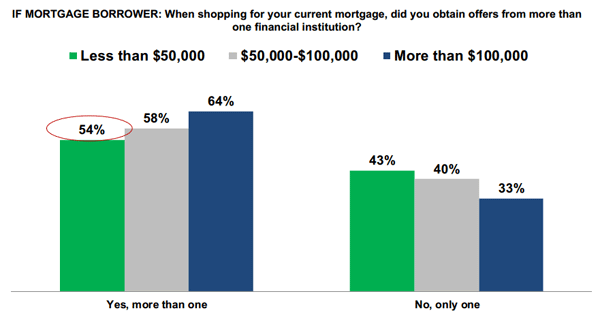

Conclusions from The Housing Survey Topic Analysis were made based on interviews with 1,000 homeowners and renters. According to the data, 54% of low income respondents shopped around for a mortgage compared to 64% of high income borrowers. This still leaves a considerable numbers of borrowers who have not shopped arouond or received multiple quotes on what may be the largest puchase they ever make.

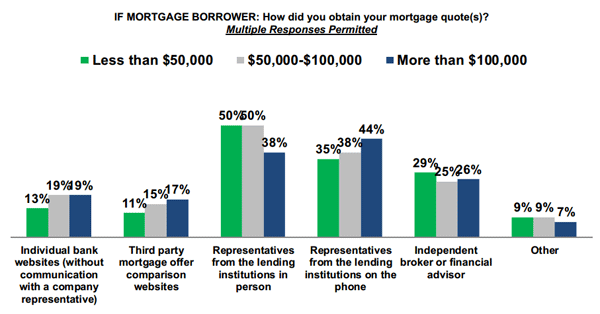

The data also shows that higher incomes individuals are more likely to use electronic means to gather comparative data. Still, only 17% of high income individuals use a third-party research site to quickly view and compare rates across banks. The number drops to 11% for low income individuals.

Lack of ARM Understanding

When asked to determine the potential maximum ARM payment, 41% of all respondents were unable to offer even a guess. Of those that did respond, the guess made (average of 10%) was significantly out of the range of what they could eventually be paying (Fannie Mae calculated the maximum potential ARM rate to be about 50%).

In responding to the report, Fannie Mae's Chief Economist Doug Duncan stated:

“Homeowners who don’t obtain multiple mortgage offers or compare rates are essentially leaving money on the table, particularly given today’s unprecedentedly low interest rates. Although a home purchase is the largest financial obligation most people will ever make, many borrowers do not fully understand their mortgage products and costs. As a result, some homeowners in this position may find themselves with unsustainable payments down the road.”

Add your Comment

use your Google account

or use your BestCashCow account