The stock market is crashing. Anyone in it is losing a fortune this week. The temptation may be to try and follow Jon Najarian’s crazy option trades and be a hero, but as a veteran of 2000 and 2008, I can guarantee you that is going to lead to further heartache. Market valuations remain elevated by any historical metric and with the possibility of a global recession caused by Coronavirus, they certainly could have further to fall.

I did not properly predict that bond yields could fall to their current levels. I don’t think they could have possibly ever gotten to these levels without Coronavirus, but they are here. And, while I have been wrong before, I remain certain that the risk of putting new money into bonds, even US Treasuries, with the 10-year at 1.20% is extraordinary should rates move the other way.

And, while cash feels awfully good right now, the reality is that bond yields and Coronavirus are going to force Fed Chair Jay Powell to cut savings rates. Today’s surveys indicate a 100% probability of a 25 basis point cut in March, and at least a 50% probability of another 25 basis point cut in April. If this happens, you will not be earning 1.70% on a savings account in 2 months.

No Penalty CDs are the best and easiest way to protect your savings from the possibility of falling interest rates. We introduced our readers to them last year in this article and also highlighted their benefits here.

No Penalty CD rates peaked in 2019 as high as 2.60% APY from Purepoint (Ally got as high as 2.30% and Marcus got as high as 2.35%). Many locked in those rates and they are not regretting having locked into these yields now.

No Penalty CD rates are much lower now; they no longer offer any premium over savings rates. But, if rates fall further as the market is predicting, locking into one of these products now will enable you to secure a penalty-free interest rate on your savings for the rest of 2020.

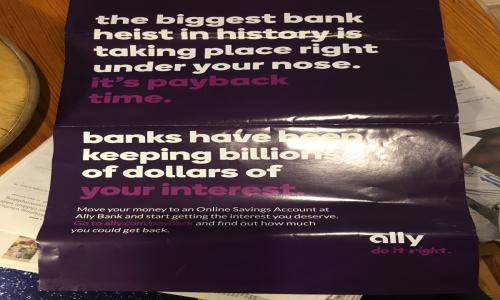

Multiple banks offer No Penalty CDs. These include Marcus, Ally, Purepoint, CIT and now CitizensAccess. We list all of the No Penalty CD products among our special CD rates here. At the very least, if you already have a savings account with one of these banks, you should log in now and convert it into a No Penalty CD. If the Coronavirus scare should pass and rates should turn and rise, you can always get out without a penalty after seven business days.

Add your Comment

use your Google account

or use your BestCashCow account