.jpg)

Surveys show that most investors have only a rudimentary idea of what their mutual funds are invested in. But there are some simple concepts which only take a few minutes to learn that can help investors earn tens of thousands of dollars, and even hundreds of thousands of dollars more without taking on any additional risk. In fact, by making your portfolio less risky, you could be earning more.

Active Funds versus Index Funds

When investors put their money into mutual funds, there are two general types of funds that individuals can invest in: index funds and actively managed funds. This distinction is extremely important to understand for your financial future.

Active Funds

Active funds are mutual funds in which a manager picks and chooses which stocks and investments to include in their fund. Wall Street often glamorizes mutual fund managers who are able to beat the market and achieve above average returns for a year or over several years. In return for actively managing the money, the funds often charge a higher expense ratio to compensate the manager for his time researching and picking stocks.

Index Funds

Index funds are funds that are created to track a certain segment of the market. Funds may track the S&P 500, the Dow, the Russell 2000, or some other market segment. The funds hold stocks in roughly the same proportion as these indexes and other than buying and selling to match the indexes, do not require a manager who researches and manages which stocks to buy and sell. Because they do not require an active manager, index funds often have much lower expense ratios.

Which Are Better?

There are two key things to know in order to determine whether to invest in an actively managed fund or an index fund.

- Over time, when including fees, index-funds tend to outperform actively managed funds. There is an entire field of study on this called the efficient market hypothesis.[1]

- Actively managed funds are expensive. The expense ratio (the ratio of cost to the value of the assets of the fund) are often 10-20 times higher than an index fund.

This second point is important. While you can't control the performance of the market, you can control the cost of your fund.

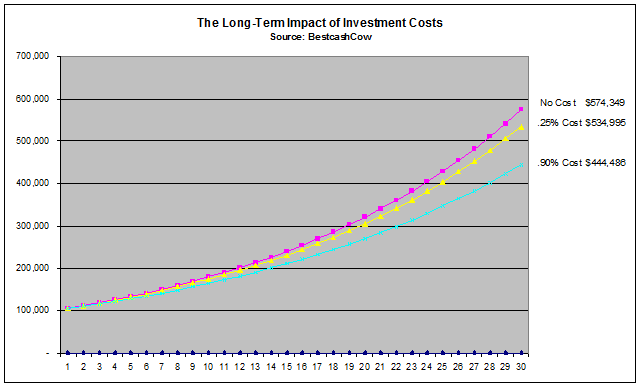

Below is a chart that shows $100,000 invested in three different funds, each with different expense ratios. The baseline fund has an expense ratio of 0%, the second has an expense ratio of .25%, which is actually a bit high for an index fund. The third chart has an expense ratio of .90%, which is the approximate asset-weighted average expense ratio for U.S. stock funds as of December 31, 2012. The assumed average annual return is 6%.

The chart shows that after 30 years, the difference between the value of the low cost fund and the high cost fund is $90,509. So, according to this scenario, for every $100,000 invested, an individual can earn an extra $100,000 over 30 years by doing nothing more than switching to a low-cost index-fund. That's extra earnings of over $3,000 per year if you divide the $90,509 by the thirty year time period.

And remember, the research shows that low-cost index funds actually outperform actively managed funds over medium to long term time horizons. For more on this please see, the excellent PBS documentary The Retirement Gamble by Martin Smith.

So, index funds have better performance and charge less in fees. Which do you think is better?

How to Find and Invest in Index Funds

Many large investment companies like Vanguard, Fidelity, Charles Schwab and others offer index funds. The best strategy is to invest in a broad index like the S&P 500 or the Dow, or a Nasdaq tracking fund. You can also find tracking funds set up to track international markets should you want some international exposure.

If you are investing your 401K, see what index-fund options are available and if your company does not have an index fund, lobby the benefits group to add one.

Control What You Can

You can't control the path of the market, but you can control how much you pay in investment fees. The research and data says that putting your money into an index-fund will provide you with an easy way to increase your returns into the future and add thousands to your pocket over time.

[1] There is a fascinating debate over the efficient market hypothesis. Successful investors such as Warren Buffett have challenged the hypothesis, using their own investment success as proof that there are inefficiencies in the market that can be exploited. An interesting discussion of this can be found here. But for the average investor, the research and data seems to indicate it is exceedingly difficult, if not impossible to beat the market.

Add your Comment

use your Google account

or use your BestCashCow account